WIESBADEN, Germany – Following Germany-wide implementation of the Value-Added Tax (VAT) App January 1, the realized savings for customers soared to more in the initial month of availability than the combined total for the preceding 8-month pilot program.

The data shows that 2,950 households received a total refund of 230,000 euros in January. In dollars, that’s an average net saving of more than $70 per household after subtracting the cost of the VAT form, said officials with the U.S. Army Installation Management Command-Europe staff that oversee the program.

The micro-purchase app program allows all U.S. Forces VAT-refund program customers in Germany to consolidate and upload their small-purchase receipts on one VAT form each month.

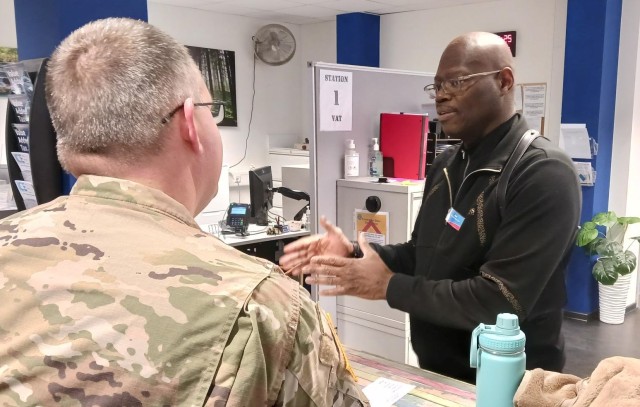

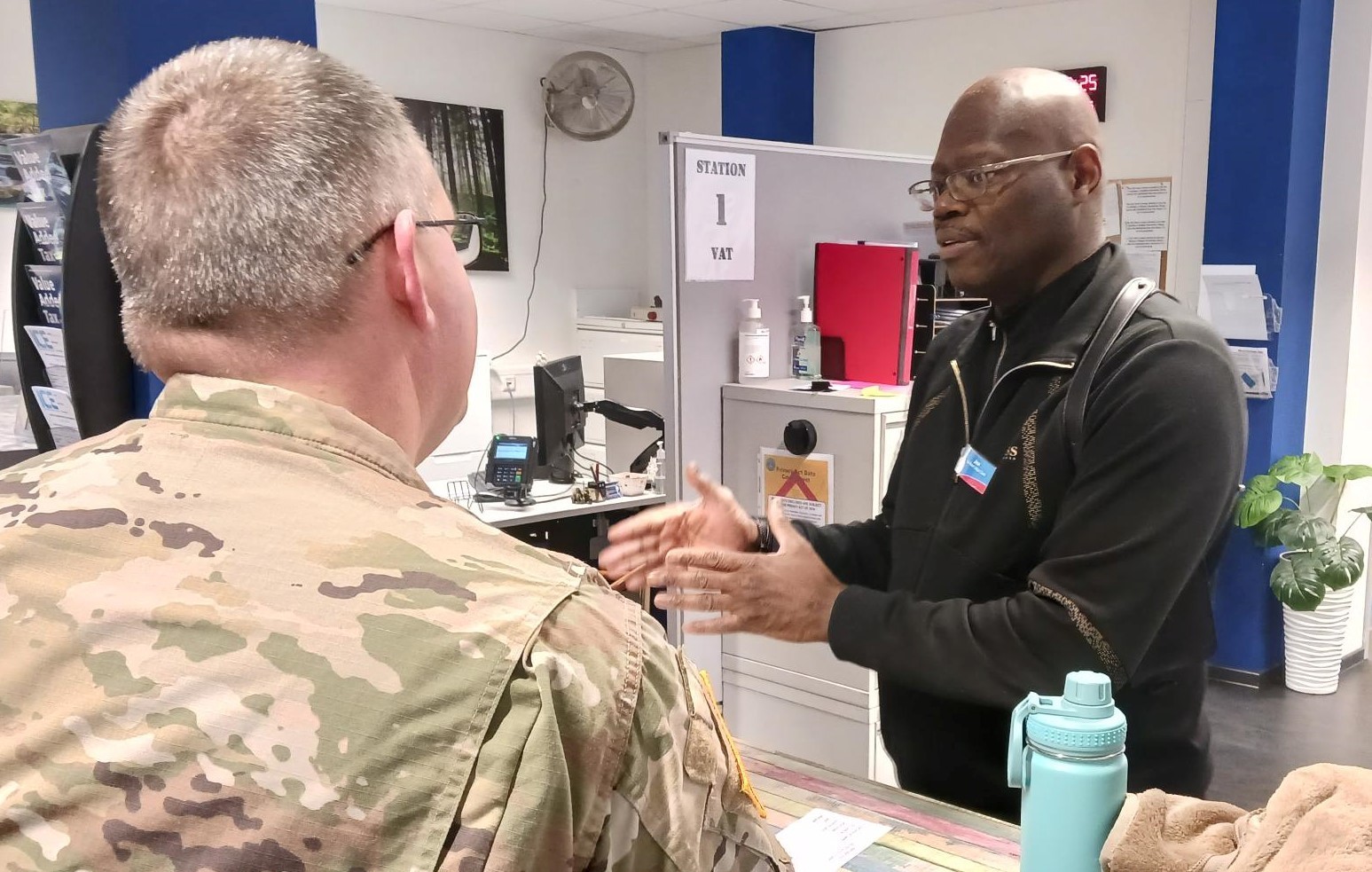

“The increase in savings is not only tied to the jump in the number of users with the program now available to all, but also with our garrison VAT offices educating customers how they can take advantage of the program,” said Jeffrey Wertz, IMCOM-E Assistant Chief of Staff for Family, Morale, Welfare and Recreation, and liaison to NOVAT GmbH, the company that developed and manages the app, called Remonon.

The micro-purchase app allows customers to obtain easy tax relief on small, everyday purchases for which the current VAT system was not ideal for in the past. As an example, someone spending 15 or 20 euros for a purchase at a German vendor might not use a $10 VAT form to save a few dollars on that transaction. However, with the app, the monthly receipts for all small purchases can be uploaded individually into the app and combined for cumulative tax savings using one VAT form.

The sponsor and family members can upload multiple receipts with a maximum individual value of 240 euros (to include the VAT they were charged at time of purchase) and not to exceed the form’s maximum value of 2,499.99 euros per household per month without the VAT.

“At the beginning of each calendar month, customers upload a valid VAT form, that they have purchased at their local VAT office, to the Remonon App,” explained Wertz. “Customers then pay full price for individual purchases at various German vendors and upload respective receipts. The app will capture these individual micro-purchases in a monthly summary invoice and reimburse customers the VAT minus trading margins.”

Customers will receive refunds of 14 and four percent for items with Value Added Tax of 19 and seven percent, respectively.

Existing VAT program restrictions and German customs laws still apply to the process, added Wertz, referencing some of the most frequently asked questions that those using the app have.

“Restrictions include not purchasing goods or services for the benefit of ineligible persons, or using it for rationed items, like vehicle fuel, coffee, liquor or cigarettes,” he said.

He clarified that wine, beer and tobacco products other than cigarettes (e.g. tobacco heat sticks, vape products, cigars) are not rationed items and can be procured tax-free with a VAT form and the micro-purchase app. In addition, liquor purchased and consumed at the vendor location, such as a restaurant or bar, is considered a gastronomic service and can be procured tax-free as well.

Another helpful hint that Wertz provided concerns paid parking: “Most payment machines have a button marked ‘Quittung.’ When pressed, the machine prints a receipt with VAT that the Remonon system can process.”

For additional information on restrictions and usage: https://home.army.mil/imcom-europe/commandinfo/army-micropurchase-app

To receive an IVN and begin using the app, and for additional questions about the app, customers should contact their garrison VAT office.

Social Sharing